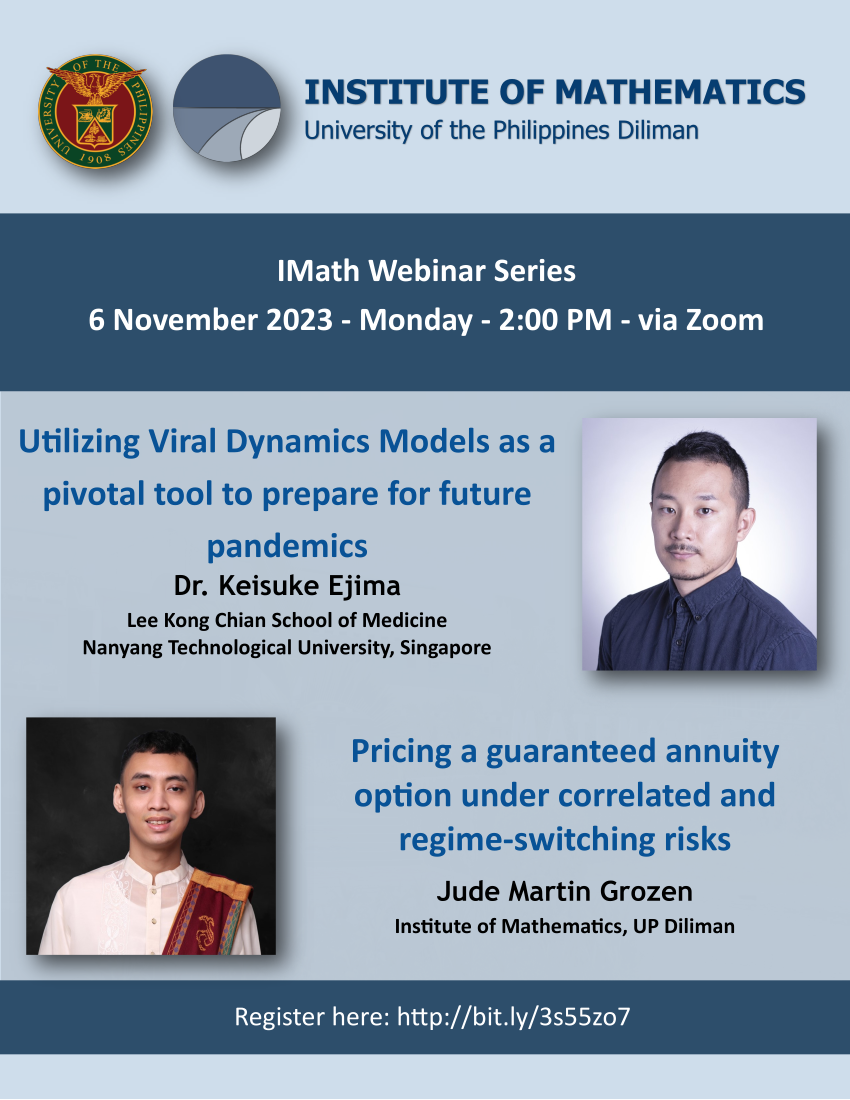

IMath Webinar Series: Dr. Keisuke Ejima and Jude Martin Grozen

You’re all invited to attend our webinar on Monday, November 6, 2023 at 2:00 PM. Our speakers are Dr. Keisuke Ejima (Lee Kong Chian School of Medicine, Nanyang Technological University Singapore, hosted by the Modelling and Applications Research Group) and Mr. Jude Martin Grozen (from the Mathematical Finance and Actuarial Science Research Group).

Dr. Keisuke Ejima (Lee Kong Chian School of Medicine, Nanyang Technological University Singapore, hosted by the Modelling and Applications Group)

Title: Utilizing Viral Dynamics Models as a pivotal tool to prepare for future pandemics

Abstract: The COVID-19 pandemic has exposed the devastating consequences and vulnerabilities of our society to infectious diseases. My overarching objective is to bolster our society’s resilience against infectious diseases by acquiring a comprehensive and quantitative understanding of the underlying biological mechanisms of infections. Specifically, I utilize mathematical models of within-host SARS-CoV-2 viral dynamics (i.e. viral dynamics models) and longitudinal viral load data collected from COVID-19 patients in Singapore to develop evidence-based interventions to control pandemics. In this presentation, I will show how viral load data can be leveraged to develop viral dynamics models. I will then provide an overview of my studies where this approach has been used to provide insights into COVID-19 epidemiology (e.g., estimation of incubation period and improvements of isolation guidelines) and clinical science (sample size calculation for antiviral clinical trials).

Jude Martin Grozen (Mathematical Finance and Actuarial Science Group)

Title: Pricing a guaranteed annuity option under correlated and regime-switching risks

Abstract: A guaranteed annuity option (GAO) converts an insured’s fund value into a life annuity subject to a guaranteed minimum rate at policy maturity. This talk presents a pricing framework for GAO that addresses the correlation, stochasticity, and regime-switching behavior of interest and mortality risks. We use the Vasicek model and non-mean-reverting Ornstein-Uhlenbeck process with a linear correlation structure to model the dynamics of interest and mortality rates, respectively. We make these models capture changes in economic regimes by incorporating a finite-state continuous-time Markov chain to modulate the change in the model parameters over time. We then estimate the model parameters using Quasi-Maximum Likelihood Estimation applied on US interest and mortality data which are derived from Bloomberg and Human Mortality Database, respectively. Semi-analytic formulas for the GAO price are then derived following the approaches in Mamon (2004) and Elliott and Mamon (2002) and implemented numerically using the Monte-Carlo simulation method. Finally, a sensitivity analysis is performed by analyzing computed GAO prices as model parameters are varied one at a time.